Improve Your Financial Skills

We offer families and individuals economic education, tools, skills,

as well as guidance on responsible money management

Who We Are

Our objective is simple, yet vital: We transform the lives of many people in Israel by mentoring & teaching the necessary behavioral skills to reach healthy and viable financial living conditions.

We guide and direct those in need to manage their money matters in an honorable, balanced and responsible way, and as a result, Paamonim strengthens Israel’s economic and social fabric.

Our Work in Action

Mentoring and Guidance

Paamonim offers personalized financial mentoring built on trust, transparency, and commitment. Our expert volunteers provide specialized, tailored solutions under Paamonim’s guidance, ensuring comprehensive support for each individual’s unique financial needs.

Emergency Aid for Crisis/War conditions

Paamonim adapts to emerging needs, such as the Oct 7th events, the Swords of Iron War, and the COVID pandemic, helping families manage finances despite IDF recruitment or civil evacuations.

Programs

Paamonim collaborates with various organizations to offer a wide range of tailored programs designed for specific groups and populations within our communities, ensuring comprehensive financial support and engagement.

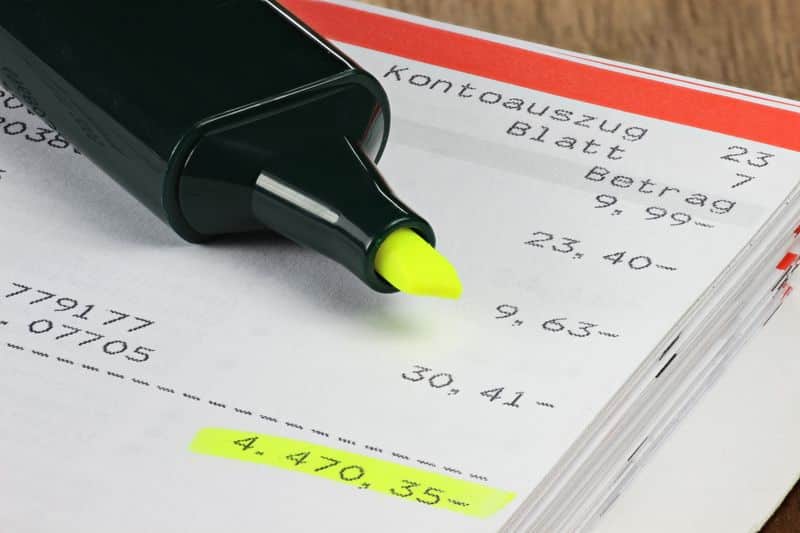

Financial Education College

Paamonim’s Financial Education College serves 18,000 people annually, offering tailored tutorials, group training for companies, and financial workshops for youth to promote wise economic conduct.

Our Latest Tips

Donate today

Your support will help Paamonim help others:

- ✓ Personalize tailored mentorship for each family’s needs

- ✓ Provide access to a dedicated loan fund and supplementary resources

- ✓ Provide collaborative support from local welfare agencies and educational institutions

- ✓ Workshops in schools and youth groups, with specialized programs for single parents, families with special needs, and at-risk populations