Why do we know how to talk to children about a variety of other important topics but when it comes to money we shy away? Generally, adults tend to see money as a complex issue that can burden the child with worries and prefer to wait until the children grow up and have to make their own financial decisions.

Paamonim advocate discourse about money and encourage parents to talk to their children about money.

Home is the main place where children acquire life skills. Attitudes to money and the formation of financial behavior patterns are largely determined at an early age, so knowledge and awareness acquired at an early age will improve your child’s ability to manage their money wisely later on. The family framework is the most appropriate place to equip children with an understanding of what money is, how to get it, what it is used for, and how to manage it.

Your children won’t sit and listen to a lecture on home economics, and speeches on the subject won’t really help. Financial education is done through ongoing conduct, in life-in-time situations. When you are debating financial issues and are about to make decisions in the field – involve the children in your actions (of course according to their age and ability to understand). Be careful to relate the messages you convey to the way you drive. Children learn by imitation, what you do has a far greater impact than what you preach.

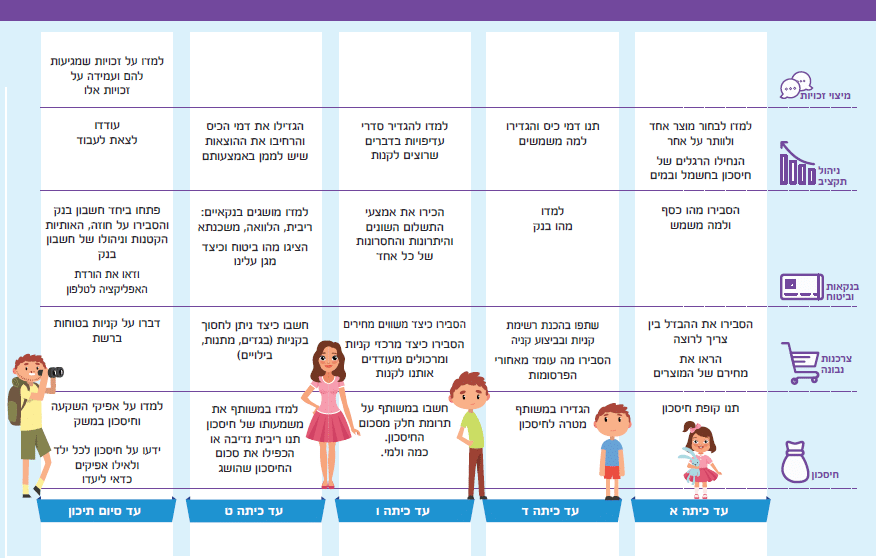

What should children be taught at any age?

Children learn by example

Think for a moment about your financial habits, think about the way your parents conducted themselves financially, can you attribute some of your financial habits to the way you saw your parents behave? We all absorbed in our parents’ home a complex of beliefs, values, attitudes, norms of behavior and habits.

What did you love about your parents’ financial management and take you for the rest of your life?

What did you like about their financial conduct and didn’t take it?

What did you not like about their financial conduct and did or did not take you further?

The same is true for your children. Children acquire life skills through observation. Skills demonstrated, discussed, and demonstrated by parents and other significant adults are likely to have an impact on habit development. You took action – discuss the considerations that led you to make the decision.

Turn everyday activities into learning experiences:

Going to the store or ATM machine can be a perfect opening for a discussion about how you use money. It should be explained to small children that the money that comes out of the wall comes out of the family’s pocket.

Going together to a bank can serve as a good time to explain banking – a bank is a commercial business whose purpose is to make a profit. Explain to the child how the bank generates its income. What a bank is used for, what is a bank account, what is a commission, what is a loan and what is savings. Going to the bank can be a good time to learn the importance of reading a contract and reading the fine print before signing, demonstrate how you insist on getting information when the subject isn’t clear enough before you make a decision. When your children see you behave in this way and you discuss the principles with them as it happens, they will be able to understand the importance of acting in the way you presented to them.

Look at the credit card statement together. Explain to your children the importance of opening envelopes and performing controls. Discuss the importance of tracking expenses over the past month and checking the source of an unrecognized expense. Looking at a large amount charged on a credit card account is fertile ground for a broad discussion about temptations and expenses and that money is a limited resource.

When it comes to them they understand best….

Take advantage in moments that directly affect your child. When decisions are made about things from the children’s world, learning will be more effective.

Do the kids want to buy a popsicle at the pool? Tell them the price of popsicle in the pool and what it costs at the supermarket or the local grocery store, talk to them about the differences in pricing of the two stores and what they stem from. Explain to them why people are willing to pay more money than necessary and emphasize the benefit of delayed gratification. On the way back from the pool, don’t forget to stop at the supermarket and buy a popsicle at a sensible price.

Do the little kids want a new game? Discuss savings for the game with them, start saving with them in a savings fund until the savings for the purchase of the game are complete.

Your son is asking for a new mobile? This is the place to talk about the importance of saving as a way to achieve goals. It is possible to discuss the common situation in which you want to purchase something, but there is not enough money for the purchase. You can always give examples of things you would like to purchase and are giving up right now because there is not enough money for it.

Your teenage daughter dreams of her own car? A dialogue can be developed on initial investment, current costs, insurance, contracts and general liability. Equip youth with knowledge about all aspects related to car maintenance, and what is required in order for them to be able to own a car while attending school.

There is nothing like personal experience, “playing” with your children with money

Let children experiment with money management, prioritization, and decision-making. Let them be wrong. Create a conversation about the considerations and choices they have made.

Very young children

Add an appropriate reference to money into children’s imaginary games, collect items at home and set up a “store”, give the child “money” to make a purchase in the “store” and teach him that not all the products in the store can be afforded to purchase.

Children in the lower grades

A lemonade stand is a great way to study a product’s value chain. Let the child purchase the raw materials himself and prepare the lemonade. Selling the product on a street fund or to neighbors will teach the young child a thing or two about work and earnings.

When the child accompanies you to the supermarket, give him a few shekels so that he can choose a surprise for himself and learn what a budget is and what can be bought with the money given to him.

Children in the upper grades

Open a bank account early for your child and let him manage his financial affairs. Equip it with an ATM or prepaid card and observe together how it works. Go over expenses with him and discuss budget matters at this age. Instruct him to determine how much he can and wants to spend on a monthly level on each of his types of expenses.

Encourage your child to work, the value of money changes when the child realizes the difficulty of earning versus the ease of spending.

Let the child do business, buy and sell, and participate in take-and-give fairs that are often held in the place of residence. In this way, he will be able to learn what costing is and what is embodied in the price of the product being purchased. Let him fail in “business” and try again.

Teach your child what contribution to others is and its importance. Encourage them to give money or by donating games or clothes they don’t need.

This is the time to build a generation of conscious consumers who know how to invest, save and give to others.